Investing in real estate can be a lucrative way to build wealth over time. If you've been thinking about this for a while and really want to start investing in real estate, what’s the first thing you should do?

That’s easy – the first thing you need to do is just to START! And I mean, now, while the prices are lower than they were a year ago.

Even if interest rates are higher than what you’d like, it may be better to buy at a “discounted” price now, then refinance when interest rates come down. This makes sense, because when the interest rates come down, the prices for real estate WILL go up.

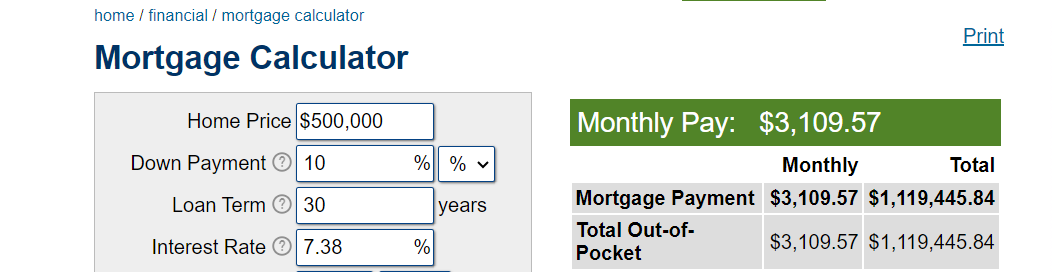

For example: If you purchased a home today with a sales price of $500,000, with 10% down, an interest rate of 7.38%, your monthly payment on a 30-year loan, without taxes, insurance, or PMI would be $3,109.

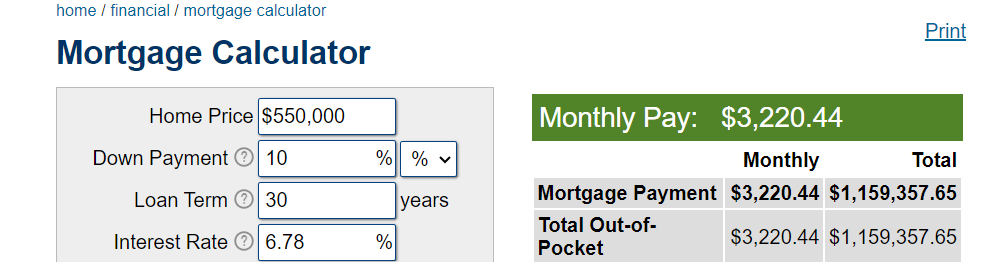

If 6 months from now, that same house sells for $550,000 but the interest rate has dropped to 6.78%, your monthly payment would be $3,320. That’s $211 more per month.

Trying to time the real estate market based on interest rate movements can be challenging. Market conditions, property availability, and demand also impact real estate prices. Waiting for interest rates to go down might cause you to miss out on good investment opportunities if other favorable conditions are present.

While waiting for interest rates to decrease, you might miss out on potential rental income and property appreciation. Real estate investments can provide steady income and long-term value appreciation, which could offset any potential interest rate differences.

Did I mention that the down payment 6 months later would be

$5,000 more? Waiting could be costly.

It's a good idea to consult with financial advisors and real estate professionals to make an informed choice.